Wahrheitsjäger

2025-10-16_Podcast-355_Endspurt oder Niedergang?

Beginn im Jahr 2019 ganz unten. Anders als in sozialen Medien, werden hier seit 2024 ältere Beiträge durch neuere ersetzt und nach oben verschoben.

Aktualisiert wird nur mehr Wesentliches. Alles andere bitte auf Telegram ansehen.

GOLD-ESEL

von Mining Race

Dein Weg in die finanzielle Freiheit

Vorteil: Ohne lästige Youtube WerbungTipp: Vollbild anschalten

Hans Peter

Freiherr von Lichtenstein

415. WISSEN-WAGEN-WOLLEN - Zeit der Neuausrichtung in den Finanzen?

Vorteil: Ohne lästige Youtube WerbungTipp: Vollbild anschalten

Bitcoin

Arte DOKU von 2021

MYSTERIUM Satoshi - BITCOIN - Wie alles begann 1-6 ARTE HD

Vorteil: Ohne lästige Youtube WerbungTipp: Vollbild anschalten

Engelsburger Neuigkeiten

Letzte Folge

Am besten die Website der Quelle des Videos besuchen

Oder die Playlist besuchem

Zu viel Info – zu wenig Zeit

Sprachnachrichten

Diese Sprachnachrichten sind auf Telegram bereits berühmt.

MARKmobil

Nachrichten von Mark Hegewald

Ein aktueller Nachrichtenüberblick, Schwerpunkt US-Wahlkampf

IBAN für Spende:

CZ92 2010 0000 0020 0178 0546

LION Media

Lindners Geständnis: „Deutschlands Absturz wird gezielt herbeigeführt“

Die deutsche Wirtschaft kollabiert im Rekordtempo und zieht die Ampel mit in den Abgrund.

Reese Report ect... vonVideo Translate Project

Ausufernder Wählerbetrug vor dem US-Wahltag '24

The Reese Report - 2.11.2024 "Während Hunderte immer noch im Gefängnis verrotten, weil sie gegen die Wahl 2020 protestierten"

Bodo Schiffmann

Bodo Schiffmann ist Arzt und seit 2020 im Widerstand

Für alle ideal, die noch am Aufwachen sind, weil Bodo selbst erst 2020 aus allen Wolken gefallen ist.

Warum Deutschland seine Geschichte nicht aufarbeitet (1) Hier geht's zum ersten Teil der wichtigen Arbeit von Bodo. Sichert die Serie auf euren Festplatten. Gute Lehrvideos für die Zukunft.

Bernie aus Australien

Bernd Bebenroth berichtet seit 2020 aus Australien

31.10.24 " Mafia" ist hinter mir her! Breaking news!: CDC in Australien!!! Albo " angeblich" korrupt, Victoria jetzt eine App wo man sehen kann, wie finanziell schlecht die Regierung ist 😉 Und Update zu meiner Kontosperrung!!

Pelsky

Jaroslav Pelsky ist Zahnarzt, der auch Molekularbiologie studiert hat.

Climate der Film auf Youtube

Zensur möglich

Wegen der Zensur ist der Film nachfolgend auch außerhalb von Youtube.

Climate der Film

deutsch synchronisiert

Hier kommen Professoren und Nobelpreisträger zu Wort, die dem Klimawahn und der kolportierten Katastrophe mit guten Argumenten klar widersprechen.

Dieser Film zeigt, dass Mainstream-Studien und offizielle Daten die Behauptung, wir erleben eine Zunahme extremer Wetterereignisse nicht stützen.

MARKmobil

Nachrichten von Mark Hegewald

Ausschnitte aus dem neuen Interview zwischen ELON MUSK und TUCKER CARLSON.

IBAN für Spende:

CZ92 2010 0000 0020 0178 0546

Deutschland - traurige Wahrheit

Scheindemokratie ist schon lange offenbar

Für Deutsche noch immer das wichtigste Video zum Anstoß des Aufwachprozesses.

Truman Show

Tom Oliver Regenauer - Vortrag, nach der Truman Show benannt. Hamburg, 3.9.2024

Tom-Oliver Regenauer ist ein angesehener deutscher Autor, Publizist und Systemkritiker, der sich vor allem durch seine tiefgehenden Analysen gesellschaftlicher, politischer und wirtschaftlicher Entwicklungen auszeichnet.

KI Generiertes Video

Deutschland Retter 24

Von der Alternativen Jugend in Brandenburg. Eigentlich logisch, erklärt, warum die Jugend AFD wählt. Mag primitiv sein, dem deutschen Geist nicht würdig, aber .... Diese Jugend kennt keinen Morgenthau- oder Kalergiplan, sie wissen nichts von den grauenhaften Plänen und Taten der Kabale..., nochmal ein sehr logischer Schritt der deutschen Jugend.

Klaus Maurer

Dr. Klaus Maurer ist von Beruf Psychiater

Rechtswissenschft und Völkerrecht hat er außerhalb der Universität studiert.

Rainer Füllmich

Deutschlands Justiz ist immer noch im Diktaturmodus

Rechtsanwalt Dr. Rainer Füllmich spricht aus der Untersuchungshaft.

Peter Freiherr von Liechtenstein

Peter Freiherr von Liechtenstein hat nichts mit dem Adelsgeschlecht Liechtenstein zu tun.

Klaus Kinsky

Wusste wohl mehr als damals gedacht wurde

Mit dem Wissen von heute: war er durchgeknallt oder nur exzentrisch, weil er Sachen wusste, die keiner sehen wollte oder konnte.

Aktuelle Kamera

Andere „Aktuelle Kamera"-Folgen ansehen

HallMack Community – Alle Kanäle und alle Auftritte, mein Newsletter etc.

DER PLAN

ZUR RETTUNG DER WELT

Ähnlich wie "Bonfire", wird auch dieser Kurzfilm in die Gechichte der Menschheit eingehen.

RFK Jr.

Wer profitiert wirklich am Ukraine-Krieg?

Nur wenige Menschen verstehen, was der Krieg in der Ukraine für große Unternehmen bedeutet - nämlich eine Chance. Es geht nicht nur um Waffen und Wiederaufbauaufträge.

Hoaxes

Die Mutter aller Hoaxes

Es ist die Mutter aller Hoaxes, weil lange vor den Menschen, die Engel im Himmel damit getäuscht wurden.

TERROR - HOAX

Jürgen Elsässer hat ein Buch darüber geschrieben.

Nach dem FAKE - Anschlag auf den Weihnachtsmarkt in Berlin im Jahr 2016 begann ein erster Aufwachprozess.

Würden die zwei Videos aus diesem Beitrag im ZDF oder ARD zur Primetime ausgestrahlt, würden nur mehr die Systemlinge selbst eine der Einheitsparteien wählen.

Aya Velázquez

Aya bei Marc Friedrich

Aya Velázquez hat die RKI-Protokolle ungeschwärzt veröffentlicht.

Raik Garve

Gesundheitslehrer

Solche Menschen sind die Zukunft der Gesundheitspolitik

Impfgeschichte

Seit 150 Jahren immer die gleichen Muster

Jede Impfung ist und war immer nur ein Schwerverbrechen von geisteskranken Psychopathen! Impfungen schützen nicht vor Krankheit, sie erzeugen Krankheit, Leid und Tod!

Nicht vergessen

Runder Tisch

Club der Lügner

RUNDER TISCH - MEINUNG ❌🇩🇪 WIE SIE UNS BELOGEN UND BETROGEN HABEN‼️ - ERMITTLUNGSVERFAHREN MÜSSEN JETZT BEGINNEN‼️ - UNTERSUCHUNGSHAFT FÜR TATVERDÄCHTIGE WEGEN VERDUNKELUNGSGEFAHR‼️

TERRAHERZ

Carsten und Stephan führen durch die neuesten Nachrichten

– Fancy unter Feuer ? – die Geister die man rief ? – Reiseunternehmen Bärbock ? – Joe mit Tatendrang ? – Pate Barack ?

Diana Pantschenko

Ukrainischen Journalistin

Milliarden von Steuergelder aus EU werden in Ukraine geklaut!

13.jähriger Erfinder

Schwurbler

Schwurblerlied

AUF1

Kurz nach der Pressekonferenz zu den RKI-Files

Prof. Homburg zu RKI-Files: Ohne Lügen wäre Lockdown nicht akzeptiert worden

Kein Krieg

Aufruf zum Tun für den Frieden

Das muß man sich immer wieder und wieder vor Augen führen, was Krieg bedeutet. Es wird nun der letzte Krieg der Kriege auf Erden geführt. Danach kommt eine ganz neue Zeit.

ORF

Vergleich mit Servus TV

Ein gutes Beispiel, wie die Mainstram-Medien die Wahrheit umschiffen und gewaltige Straftaten verharmlosen. 23.07.2024

Hätten wir einen Rechtsstaat, würde in Österreich der damalige Minister Anschober jetzt in Untersuchungshaft wandern. In Deutschland würde das Parlament die Immunität von Span aufheben.

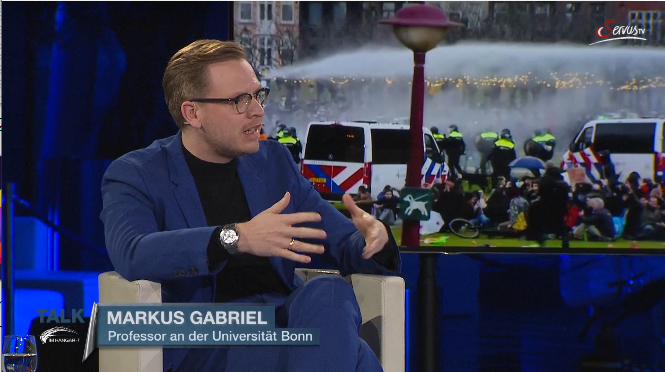

SERVUS TV

Der einzige Fernsehsender, der die Wahrheit nicht vertuscht

ServusTV Bericht über den RKI-LEAK 23.07.2024

Justiz ganz anders

Rechtliche Grundlagen der modernen Sklaverei

Hans Xaver Meier

Vortrag:

Wissen über Gegenwehr bei Behördenbescheiden.

Sonntagsrunde

mit Burkhard Müller-Ullrich

Publizisten diskutieren über Themen der Woche - kritisch, humorvoll, eloquent und kompetent. Jeden Sonntag mit jeweils drei stets wechselnden Gästen.

Compact TV

13.7.2024 Interview mit der Kreml-Sprecherin

Dieser Ausschnitt aus dem Interview war vermutlich der Auslöser für das Verbot des Magazins und der Hausdurchsuchung beim Herausgeber Elsässer!

Armin Paul Hampel

Journalist, vormals Abgeordneter im Deutschen Bundestag.

Zum Verbot von Compact.

Compact TV

Erstes Statement Jürgen Elsässer

Erstes Medien-Verbot in der Geschichte der BRD.

Nancy Fäser

Ist sie jetzt völlig durchgedreht?

Ohne Worte.

AUF1

Erste Details zum Verbot von COMPACT

Wir haben den Durchsuchungsbescheid. AUF1-Nachrichtenleiter Martin Müller-Mertens hat mit COMPACT-Chef Jürgen Elsässer gesprochen.

Compact TV

Attentat auf Trump

15.7.2024

HISTORISCH: Wie dieses Attentat die Welt verändern wird!💥

Alex Jones

Höchste Alarmstufe Rot!

Der globalistische tiefe Staat ist verzweifelt und wird versuchen, Trump erneut zu töten!

An die Globalisten und ihre Lakaien: Gebt jetzt auf! Oder ihr werdet vernichtet!

Ken Jebsen

Aufruf zur DEMO in Berlin

📅 - Kundgebung Samstag, 03. August 🕐 15:30 - 20:00

🚛 - Aufzug 12:00 Uhr - 15:30 UHR

BITTEL TV

Roger Bittel für Reiner Füllmich

Lied für Reiner

Titel: Freiheit für Reiner

Grosses Dankeschön an Renato für diesen tollen Song

Qlobal-Change

Das Repräsentantenhaus wird eine Untersuchung der tragischen Ereignisse durchführen

Die Direktorin des Secret Service, Kimberly Cheatle, und andere zuständige Beamte des DHS und des FBI werden so bald wie möglich zu einer Anhörung vor dem Kongressausschüssen vorgeladen.

Zeuge berichtet

Der Trump-Attentäter wurde vorher beobachtet

Nur eine kleine Kopfdrehung rettete das Leben von Trump.

Wird spannend, die Aufklärung. Riecht nach Inzenierung oder Beteiligung des Secret Service, wie beim Kennedy-Attentat.

1961 Hotel Willard

Intercontinental Hotel Washington DC

Benjamin Harrison Freedman

Freedman hielt diese Rede im Alter von 71 Jahren im Luxushotel Willard, nahe dem Weissen Haus. Seine Erzählungen sind mehr als nur Erinnerungen.

Schwurgesetz

Schwurgesetz und Amtseid.

Es sind besonders die Schwüre in oft geheimen Gemeinschaften, die unvereinbar mit einem Amtseid sind. Der Ausrede, dies wären nur alte Traditionen, die keine reale Geltung mehr haben, wird mit diesem Gesetz eine klare Abfuhr erteilt.

Wissensmanufaktur

Andreas Popp: Warum es nicht zum 3. Weltkrieg kommt.

Die Welt ist viele Jahrzehnte, evtl. sogar Jahrhunderte, getäuscht, ausgeraubt und zunehmend in die Versklavung geführt worden. Von einem rücksichtslosen Netzwerk - von für uns bis vor Kurzem - recht unsichtbaren Figuren. Und jetzt wird es interessant.

Ken Jebsen

Heute: Kayvan Soufi Siavash

Im Interview über Glück, Intelligenz und Kinder...

Schandmaria

Geköpfte Skulptur wurde aus dem Linzer Dom entfernt.

Sie wird nicht wieder ausgestellt.

Orban

Der Ungar machts einfach

6.7.2024

Mal sehen, ob mehr daraus wird.

TIPP:

Youtube kann automatische Untertitel erzeugen.

Und zeitgleich in jede beliebige Sprache übersetzen.

Naturschule

Die Zukunft hat schon begonnen.

Die Freude am Lernen und die natürliche Begeisterungsfähigkeit stehen im Mittelpunkt.

Die SchülerInnen lernen als festen Bestandteil des Unterrichts die Natur kennen, lieben und nachhaltig zu schützen. Ihnen wird so eine emotionale Beziehung zur Natur ermöglicht.

SOZ - Gipfel

SOZ-Gipfel in Astana 5.7.24

Heute ist der letzte Tag des Gipfels der Shanghaier Organisation für Zusammenarbeit in Astana, Kasachstan.

Entmachtung von G7 und NATO ist nun nur mehr eine Zeitfrage.

RKI - Files

Buch von Bodo Schiffmann

Bitte zahlreich besorgen.

Der ultimatve Beweis für das Corona-Verbrechen.

Damit könnt ihr auf die Schnelle Beweise vorlegen.

Nikola Tesla 2024

Heutige Erkenntnisse

Tesla wird bald wieder der größte Erfinder sein

Albert Einstein war ein korrupter Schwachmat

J.P.Mogan war der größte Verbrecher seiner Zeit

Bald werden die Erfindungen Tesla`s die Welt revolutionieren

Rechts/Links

Rechts ist richtig - Nazis sind links!

Dass die Nazis links waren ist heute für jeden klar, der sich abseits des oberflächlichen Mainstream Gebrülls mit der Thematik beschäftigt.

Die Nazis kämpften auch gegen Rechts, so war ein Slogan der Hitler Jugend "Der Feind steht rechts".

Prof. Jeffrey Sachs

Wie man die Ukraine vor den USA retten kann

Diese Folge (Juli/24) wirft auch ein Licht auf die gescheiterten Friedensverhandlungen zwischen der Ukraine und Russland im März 2022 und unterstreicht, wie wichtig eine effektive Diplomatie ist, um die verheerenden Militäraktionen zu stoppen und Menschenleben zu retten.

Real Debate

Robert F. Kennedy Jr. - Die echte Debatte

RFK Jr. veröffentlichte seine eigene Debattensendung zur Trump-Biden Debatte, da er zu dieser Debatte nicht zugelassen wurde, obwohl er als unabhängiger Präsidentschaftskandidat kandidiert.

Katholischer Bischof

Es gibt sie auch bei uns

Bischof Marian Eleganti über das Versagen der katholischen Hierarchie während der Corona Krise.

27.06.2024

Dammbruch 06/2024

Das US COVID-Impfmandat ist gefallen!

Dr. David Martin macht klar, warum das 9. Berufungsgericht der Klage der Lehrervereinigung von Los Angeles statt gegeben hat.

Framing Rechts/Links

Nazi, Nazi .....rechts, rechts, rechts

Ist man noch Opfer dieses Framings, reicht es aus dieses Buch zu überfliegen, um sich von diesem Framing zu befreien.

Darüberhinaus enthält dieses Buch so manch andere Überraschung der jüngeren Geschichte.

DIE GROESSTE SHOW DER WELT

von Good Lion Films

Ausführlicher (1:32:00) als Bonfire.

Ab dem Jahr 2026 wird jeder Mensch der Erde diese beiden Filme kennen.

Anmerkung: Original in Englisch ist besser.

Bonfire

Die Kapitulation der Welt

Der berühmteste Pflichtfilm (42 min) für alle Aufgewachten.

Eines der wichtigsten Videos. Zum Aufheben/Abspeichern

Anmerkung: Original in Englisch ist besser.

Christian Drosten

Läuft immer noch frei herum (März 24)

Er ist der Mann, der in der Corona-Plandemie zahlreiche Menschenleben auf dem Gewissen hat.

Dieses Video klärt über den Scharlatan und Menschenfeind auf, es ist absolut sehenswert💥

Erst wenn die deutsche Justiz IHN verurteilt, geht die Show weiter, bis zum Ende.

Wetteradler

- Faktenchecker - Antennentechnik - Wetterkontrolle - Universitätsprofessoren - Nobelpreisträger - Erwachen der Menschheit - Zensur

Trump Bibel

Was hat es damit auf sich?

Fast Niemand kennt die wahren Hintergründe.

Ist für die allermeisten Menschen völlig neu.

Wer ist Q

Das Rätsel löst sich allmählich

Vorschau auf eine mögliche nahe Zukunft

Telegram sollte direkt von Telegram.org installiert werden. Die Versionen in den PlayStore's sind manipuliert.

Die BIBEL

Wichtiger, denn je.

Dieses Buch hilft sehr, die Bibel zu verstehen und zum GLAUBEN zurückzufinden.

Überarbeitete Ausgabe 2022. Nun auch in englischer SPRACHE.

ProphetieErzbischof mit Anstand

Es gibt zumindest noch Einen.

Video bitte downloaden und an kath. Pfarreien senden.

2020News

Fall der Kabale!

PIZZAGATE und mehr........

Auch wenn es sehr unangenehme Wahrheiten sind. Ein unbedingtes MUSS für alle AUFGEWACHTEN.

Matrix 4

Ganzer Film und Analyse

Wirklich verstehen können die Matrix-Filme nur aufgewachte Menschen.

Alles NEU!

Neue Zeit - Neue Medizin.

Der Paradigmenwechsel nimmt Fahrt auf.

Lügen der Kabale!

Die Wahrheit wird immer offensichtlicher.

Die Schlinge für die hochrangigen Knechte der Kabale wird immer enger. Sie hätten nie gedacht, verlieren zu können.

Entscheide Dich!

!!! JETZT !!!

Bist Du gehorsam oder tapfer?

Den 1.Schritt hast Du schon getan. Kehr nicht mehr um zu Deinem TV-Gerät.

Aufarbeitung beginnt!

Corona Verbrechen darf nicht vergessen werden.

Bundesministerin für Inneres sollte als erstes angeklagt werden.

Was ist wichtig?

🎥 ALIKE: Worauf es im Leben wirklich ankommt😍

Dieser Kurzfilm zeigt, was im Leben wirklich zählt. Und das völlig ohne gesprochene Worte.

Impfaufklärung

Stand der Dinge Feb. 2022

Nicht ein Mensch würde sich stechen lassen, bereits wenn er nur 10% dieser Info glaubt.

Unbewußt!!!!!

Ein sogenannter "Freud'scher Versprecher".

Bundesministerin für EU und Verfassung Mag. Karoline Edtstadler rutscht dadurch die Wahrheit raus.

Schützt Eure Kinder !

Eine deutsche Mama erklärt hier umfassend wie es geht...

Für österreichische Mamas ist es noch einfacher, denn in Österreich gibt es das Recht seine Kinder zu Hause zu unterrichten.

Original link zur Voice:https://t.me/DieHelfendeHand/12852

Eilmeldung!!!!!

CORONA ist vorbei.

Der Virus SARS-Cov-2 wurde in Spanien verhaftet.

Hochverrat

Neuauflage des älteren Artikels - Landesverrat zu Gunsten einer fremden Macht

Die Anklage hat sich erhärtet. Beweisfälschung zum Schaden der Republik Österreich und Hochverrat.

Schuldig im Sinne der Anklage.

ORF

Kein Slapstick. Kam tatsächlich so im ORF.

Wie verblödet kann ein gehirngewaschener ORF-Konsument werden? Ist wohl nicht mehr zu toppen.

Nano-Rasierklingen

Das Gift ist zum Teil viel primitiver. Ein Chemiker klärt auf.

Es gibt bei der Produktion keine Abriebe von solchen Stoffen. Bleibt nur noch ABSICHT.

!!! KRIEG !!!

Der Weltkrieg gegen die Menschen nähert sich seinem Höhepunkt.

Viele Menschen werden sterben.

Tote Kinder

Schule in Südafrika

HÖRT ENDLICH AUF DIE CORONA LÜGE ZU GLAUBEN!!!!

HÖRT ENDLICH AUF DIESEN SKLAVENFETZEN ZU TRAGEN UND ATMET WIEDER!!!

DREHT ENDLICH DEN FERNSEHER AB UND DENKT SELBST!!!

Sklaverei

Wir leben in einer rechtlichen MATRIX

Es ist kein Geheimnis, dass die Menschheit von den Mächtigen kontrolliert wird, die die multinationalen Konzerne und die Banken leiten.

Aber die Befreiung hat begonnen......

Prinz Charles

Es ist nur noch lachhaft.

Prinz Charles spricht mit einem frisch "geimpften" Mann, der gerade aus dem "Impf"-Buss steigt und bei der kamerawirksamen Frage "how you feel?" antwortet der frisch Gespritzte "GREAT" und bricht zugleich zusammen.

Dauerhaft vorübergehend

Ken Jebsen

Wie weit würdet ihr gehen?

Mehr vom aktuellen KenJebsen(Kayvan Soufi-Siavash)

Echter Arzt

Es sind vor allem die Ärzte, die ENDLICH wieder zur Vernunft zurückkehren müssen.

Anonymus

Hintergründe zum Corona-Skandal

Einstieg in die Welt von Anonymus.

Langsam beginnen. Es wird auch viel Unsinn in der Welt der "Anons" verbreitet.

dieBasis

Werbespot für die deutsche Bundestagswahl.

Gott sei Dank wurde der anfängliche Wahlspot durch diesen hier ersetzt.

Die Gruppe um DR.Wolfgang Wodarg hat sich zum Glück durchgesetzt.

Gelöscht von Youtube

Gerade solche Videos sind offensichtlich gefährlich.

Für Aufgewachte nichts Neues. Aber dieses Video könnte gefährlich viele aufwecken.

4.9.2021: Original auf Youtube wieder freigegeben.

Monika Donner

Die Juristin Monika Donner arbeitet für das österreichische Verteidigungsministerium.

Beamte hätten die Pflicht die Administration aller Maßnahmen der Regierung zu verweigern. Ansonsten mache sich jeder Beamte laut Gesetz strafbar.

Ernst Wolff

Bestechende Analyse

Diese Rede von Ernst Wolff zeigt uns schonungslos das wahre Ausmaß der Krise. Ende August 2021.

MFG Wahlkampfauftakt

MENSCHEN FREIHEIT GRUNDRECHTE

Am 19.8.2021 fand der Wahlkampfauftakt in der ehemaligen Tabakfabrik in Linz statt.

UK und Frankreich

Ein Blick hinaus aus dem deutschen Sprachraum Europas.

Französischer Impfexperte Professor Christian Perronne und Dr. Anne-Marie Yim im Interview.

Es lohnt sich, auch den übersetzten Text(deutsch) unter dem Video zu lesen. Man ist bei der halben Laufzeit des Videos damit fertig.

Geimpfte Christen

Jeder Christ sollte dies wissen, bevor er sich dieses Zeug in den Körper spritzen lässt.

Gott wird es nur verzeihen, wenn DU von Herzen ehrlich bereust.

Weltweite Einheit

Warum machen so viele Staaten eine fast einheitliche Politik?

Der vom Corona-Ausschuss angehörte Autor und Journalist Ernst Wolff gibt eine sehr plausible Antwort auf diese Frage.

Die Masken der Scheindemokratien fallen.

Suche nach den Wurzeln

Der Corona Wahnsinn - Transhumanismus - Biodigitale Welt - Malzeichen des Tieres

Der Corona Skandal beschleunigt die Offenbarungen von offenen "Geheimnissen" rasant. Das biblische "Malzeichen des Tieres" wird immer konkreter.

Info für Christen

Auch wenn dieser Prediger im religiösen Bereich umstritten ist, seine Infos zum Corona Skandal sind auch für andere Christen wichtig.

Dr. Walter Veith ist der berühmteste Prediger in der Kirche der Adventisten.

Wahrheit über Corona

Der 2.Teil der Servus.tv DOKU mit Dr.Haditsch

Das wahre Verbrechen am Corona Skandal sind die Impfungen. Dieser 2.Teil befasst sich auch damit.

Utopia 2013

Heute: Juni 2021

Beklemmend, wenn man die Szenen mit der heutigen Realität vergleicht.

Hier einige Ausschnitte aus der Serie Utopia aus dem Jahre 2013. Uns wird genau gezeigt, was sie in heutiger Zeit umsetzen. Von einer Plandemie bis zur Kinderfeindlichkeit.

Herdenimmunität

Jede Epidemie durch einen Atemwegsvirus endet mit Herdenimmunität.

Prof. Dr. Knut Wittkowski macht unmissverständlich klar, dass die Corona Massnahmen viele Menschen getötet haben. Also genau das Gegenteil von dem bewirken, das uns propagiert wird.

Neuer TV-Kanal

Mutige Journalisten gründen einen eigenen TV-Kanal .

Chefredakteur ist Stefan Magnet. Mit dabei ist auch die Chefredakteurin der Zeitung WOCHENBLICK, Elsa Mittmannsgruber. Auch über Telegramm erreichbar. https://t.me/auf1tv

Dr.Wolfgang Wodarg

Einer der ersten Aufdecker des Corona-Skandals.

So wie Dr.Bhakdi wurde auch Dr.Wodarg über das Maß des Erträglichen hinaus von den Mainstream-Medien diffamiert. Doch bald werden sie mit Sicherheit Heldenstatus erhalten. Manche Medienvertreter werden jetzt schon ganz ruhig und bereuen bereits.

Corona Ausschuss

Mai 2021

Bereits die 53. Sitzung

Die wichtigste Plattform zur Aufklärung des Corona Skandals ist die Stiftung Corona Ausschuss. Nicht nur für die deutsch sprechende Bevölkerung, sondern weltweit.

Die Gründer sind ausnahmslos deutsche Rechtsanwälte. Sie werden bei der späteren juristischen Aufarbeitung dieses politischen Skandals eine wesentliche Rolle spielen

Mundtot gemacht

Eine weitere DOKU für die Schlafschafe, die noch immer der Regierung vertrauen. WACHT ENDLICH AUF!

Das wahre Verbrechen am Corona Skandal sind die Impfungen.

Corona Skandal

Eine DOKU für die Schlafschafe, die noch immer der Regierung vertrauen. WACHT ENDLICH AUF!

Das wahre Verbrechen am Corona Skandal sind die Impfungen. Leider wird darüber in diesem ersten Teil noch nicht gesprochen.

Hoffen wir auf den zweiten Teil.

Kindeswohl

Der pensionierte Familienrichter Hans-Christian Prestien erklärt im Detail die Gesetze und Vorgehensweise damit Familienrichter aktiv werden, wenn Kinder unter den CORONA-Maßnahmen leiden.

In Weimar und Weilheim hat dies bereits zum Erfolg geführt.

Diese Vorgehensweise sollte unbedingt auch in Österreich versucht werden.

Hierher verirrt?

Für alle, die noch immer nicht geschnallt haben worum es bei der Corona Pandemie in Wirklichkeit geht.

Regionalzeitungen wie der oberösterreichische Wochenblick sind zur Zeit die einzigen Printmedien die nicht korrumpiert sind.

Bitte unterstützt sie, kauft sie am Kiosk oder abonniert diese Zeitungen.

Karrenbrock

So gut wie jeder in Deutschland, der Schweiz und Österreich kennt die Stimme dieses Mannes.

Welchem wunderbaren Menschen diese Stimme gehört erfährst du hier.

Moralkompetenz

Moralkompetenz wird wohl das WICHTIGSTE Gut sein, wenn wir demnächst unsere Demokratien wieder neu starten.

Professor Lind: georg.lind@moralcompetence.net Anmeldung zu Workshops möglich.

Ende Februar 2021

Wenn solche Infos bei ORF, ARD oder ZDF zu sehen wären.

Prof.Dr.Sucharit Bhakdi

Prof.DDr.Martin Haditsch

Prof.Dr.Andreas Sönnichsen

The only one

Der einzige deutschsprachige Fernsehsender, der zumindest ansatzweise den Kodex der Journalisten beachtet.

Diese Reportage zeigt den Gegensatz zum Haltungsjournalismus.

Der Sender schlängelt sich wie ein Schiff durch die Wirren des Wahnsinns. Er wird am Ende wahrscheinlich der einzige sein, der sein Schiff unbeschadet durch die Untiefen führt.

Der Freie Wille

Der freie Wille dürfte vielen Staatsorganen verloren gegangen sein.

Wie sonst ließe sich erklären, dass enorm viele Beamte auf der ganzen Welt den derzeitigen Wahnsinn mitmachen.

Whistleblower

Kapitalverbrechen unter den Augen der Justiz

Nun ist es soweit. Setzt sich das Böse in der deutschen Justiz und Polizei durch?

Wenn ja, dann haben wir bereits eine Wiederholung der Zustände zum Ende der Weimarer Republik.

Angelo Giorgiani

Dr. Angelo Giorgiani ist ein italienischer Richter.

Früher war Angelo Giorgiani Staatsanwalt und Mafia-Jäger.

Besonders seine Aussagen zu den Vorgängen in Israel sind sehr besorgniserregend.

Straftat begann viel früher

Die Journalistin Jane Bürgermeister konnte dies damals aufklären.

Jane Bürgermeister erstattete damals Anzeige, auch gegen den damaligen Bundeskanzler Werner Faymann. Vielleicht erklärt das auch das kuriose Verhalten der heutigen SPÖ-Spitze.

Wer ist Klaus Schwab?

Ist Schwab unschuldig? Hat er ein Gesetz verletzt?

Klagt diesen Mann an. Er ist einer der weltweit Hauptschuldigen für den Corona-Wahnsinn. Er hat viel Schuld auf sich geladen, von der Gründung einer kriminellen Vereinigung bis zur Fälschung von Beweisen, die zu unglaublich hohen Schäden in viele Staaten geführt haben.

§258 StGB - Appell

Appell an die Staatsanwälte - Landesverrat zu Gunsten einer fremden Macht

Beweisfälschung zum Schaden der Republik Österreich.

Schuldig im Sinne der Anklage.

Wahnsinn ohne Ende?

1.2.2021 - Wichtige Info - Recht und Gesundheit

Ein österr. Lungenfacharzt erklärt die FFP2-Maskenpflicht.

Zwei österr. Anwälte erklären die rechtliche Situation. So gut wie alle aktuellen Verordnungen sind verfassungswidrig und werden vom Gericht aufgehoben werden. WANN???

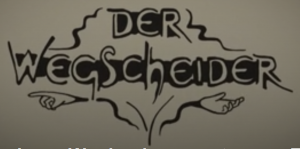

Servus - Mainstream?

Die Nachrichten von Servus TV sind ganz klar Mainstream.

Der Indentant des Senders Ferdinand Wegscheider verweist oft darauf, nicht zum Mainstream zu gehören.

Micheael Fleischhacker ist zwischen Mainstream und Freien Medien. Er gibt völlig bornierten Infektiologen, wie Richard Greil, viel Raum, lädt aber auch Kritiker ein, die vom Mainstream gemieden werden.

Skurrile Planspiele

So richtig skurril, wenn man das erste Mal davon hört und sieht.

Nach eingehender Betrachtung weicht die Skurrilität einem Kopfschütteln. Am Ende bleibt nur mehr bedauerndes Mitleid mit diesen Menschen. Wie krank müssen die sein?

33. Sitzung

Zum Jahreswechsel 2020/21 eine Kurzfassung des dreistündigen Lifestream.

Der Corona Ausschuss befasst sich mit den beginnenden Impfungen.

Dr. Füllmich

Die bisher umfassendste Analyse zur Situation Ende 2020

Der Jurist Dr. Füllmich wird wohl zur wichtigsten Person bei der Aufarbeitung des Corona-Skandals werden.

Lichtblick

Endlich wacht zumindest eine politische Partei auf

Die österreichische FPÖ stellt sich nun voll gegen die Massnahmen der Bundesregierung.

Der Klubobmann kündigt einige Maßnahmen an.

U-Ausschuss

ACU Deutschland und Österreich haben sich offensichtlich schlafen gelegt.

Nicht so die "Stiftung Corona Ausschuss" in Deutschland

Dort hat am 18.12.2020 die 32. Sitzung statttgefunden. Dr. Füllmich und seine Mitstreiter sind sehr aktiv. Diesmal haben sie verschiedene Vertreter von Religionsgemeinschaften eingeladen.

⭐⭐⭐⭐⭐

5 - Sterne Betrug bei Amazon und Co.

Einfach krass. Unsere Justiz sieht seelenruhig zu, wie sich dubiose Leute durch Fake-Bewertungen im Internet Geld verdienen.

In Wahrheit beweist Frontal 21 genau das Gegenteil: Jameda schadet mehr als es nutzt.

Jahresrückblick

12.12.2020 Der letzte Betrag von Dr. Ferdinand Wegscheider im Jahr 2020.

Herr Wegscheider blickt auf die grandiose Leistung unserer Politiker des Jahres 2020 zurück.

Corona Quartett

6.12.2020

Weder der Sender, noch die Teilnehmer dieser Runde erkennen das wahre Motiv hinter den Corona Maßnahmen.

Weder der Sender, noch die Teilnehmer dieser Runde erkennen das wahre Motiv hinter den Corona Maßnahmen.

Man glaubt, ohne Polizeistaat den kommenden GREAT RESET nicht bewältigen zu können.

Man glaubt, ohne Polizeistaat den kommenden GREAT RESET nicht bewältigen zu können.Bullshit

Nur für Leute, die noch Denken können.

Brilliante Rede von Prof. Norbert Bolz. Am Ende der Rede bringt er den politischen Zeitgeist auf den Punkt, indem er den amerikanischen Begriff "Bullshit" aufgreift.

Bolz ist einer der letzten seiner Art.

Lob oder Kritik?

5.12.2020 Wieder ein genialer Beitrag von Dr. Ferdinand Wegscheider.

Herr Wegscheider lobt die umsichtige Politik unserer Regierung. In Österreich bezeichnet man diese Art "Auf die Schaufel nehmen".

Es wird immer grotesker - An sich gebildete Menschen schnallen immer noch nicht, in welchen Ausmass sie "verarscht" werden.

Gesundheitssystem

Qualitätsanalyse

Das deutsche Gesundheitssystem und die Missstände.

300 Milliarden Umsatz pro Jahr.

Massentest

Wien beginnt als erste Stadt mit sinnlosen Tests.

Genau für derartige Sendungen wäre der öffentlich rechtliche Rundfunk da.

Unsere Medien versagen leider völlig.

ZDF heute live

Am 23.11.20 wagte der ZDF es, einen Kritiker zu Wort kommen zu lassen.

Allerdings nicht für die Schafe vor den Bildschirmen. Nur für Streamer.

Aber immerhin. Der ORF ist weit davon entfernt.

Untersuchung

Eine Schande für unser Parlament

Totalversagen unserer Abgeordneten im Parlament.

Und eine Schande für unseren Bundespräsidenten. Wie kann er nur tatenlos zusehen, wie unsere Verfassung mit Füssen getreten wird.

Anwälte wehren sich...

....unsere Richter bremsen gewaltig.

Wiener Anwalt klagt an.

Die im Video besprochenen Verfahren sind unterhalb des Fensters verlinkt.

Auf MEHR ANSEHEN klicken

Generationen

1968er Bewegung und ihre Kinder

Prof. Dr. Norbert Bolz spricht über Grundsätze und bezeichnet die neue Ideologie der "Grünen Bewegung" als parareligiös.

Obiges Video zeigt Ausschnitte eines längeren Videos. Das gesamte Video findet man unter https://www.youtube.com/watch?v=aDjKxDydY4Q

Grundrechte

21.11.2020 Bisher bester Beitrag von Dr. Ferdinand Wegscheider.

Herr Wegscheider wird seit Jahren diffamiert, indem man ihn in die rechte Ecke drängen will.

Wacht auf....

... und habt keine Angst

Prof. Dr. Sucharit Bhakdi überlegt, Deutschland zu verlassen.

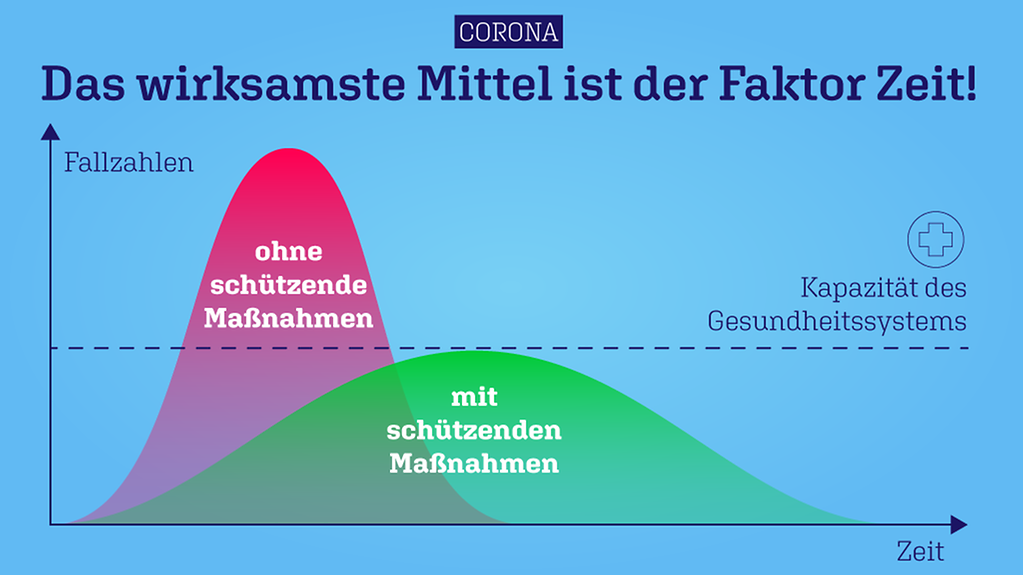

Intensiv

Diese Grafik sagt eigentlich alles

Dabei will man uns ständig weis machen, COVID würde alles überlagern.

Unbemerkte Ansteckung

Aufruf an alle positiv Getesteten.

Bitte schreibt Mails an info@positiv-getestet.de

Schreibt in die Betreffzeile:

Euer Alter - das Datum des Tests - den wievielten Tag nach dem Test - Eure Symptome

Am besten:

nach 1 Tag, nach 5 Tagen, nach 9/10 Tagen und nach 14 Tagen

Schickt diesen Aufruf an Freunde, die positiv getestet wurden.

Unbemerkte Ansteckung

Fakten vor Gericht

Inzwischen gibt es sogar bei Gericht Fehlurteile, weil Vermutungen anstatt Fakten als Beweisgrundlage dienen.

Prof. Dr. Sucharit Bhakdi bringt hier Fakten, die unwiderlegbar sind.

Bitte vor Gericht verwenden!

Corona Quartett vom 15.11.20

Angeregte Diskussion

Der Moderator schaffte es tatsächlich, anfänglich völlig unversöhnliche Standpunkte, am Ende zu einem Konsens zu führen. Respekt.

Trotzdem muss man sich sehr wundern, wenn derartige Ignoranten, wie der Teilnehmer aus Ulm, in politischen Ausschüssen über die Maßnahmen gegen die Epidemie entscheiden.

Demokratie Ade!

Wegscheider 14.11.20

Einfach nur unglaublich.

Was machen bloß die Oppositionsparteien.

Besonders haarstäubend:

Hätte sich die SPÖ-Chefin besser informiert und die schwedischen Parteifreunde gefragt, wäre sie mit Garantie die nächste Bundeskanzlerin der Republik Österreich.

Talk vom 12.11.20

Herdenimmunität

Die Herdenimmunität wurde kurz erwähnt.

Der Epidemiologe der Runde hat nicht reagiert. Ist das nicht der springende Punkt?

Die geringe Letalität dieses Virus gibt uns die Möglichkeit, so rasch als möglich, eine Herdenimmunität zu erreichen.

Auch ohne eine Impfung.

Corona FAQ

Alle Fragen zu Corona

Die Epidemiologen der Great Barrington Deklaration beantworten die wichtigsten Fragen.

Jeder, dem die Demokratie am Herzen liegt, sollte diese Antworten kennen.

Angst Ernst nehmen

Daniele Ganser in Wien zum Thema Corona.

Der schweizer Historiker und Friedensaktivist war Ende Oktober in Wien.

Er wird vom Mainstream stark angegriffen. Besorgt Euch sein neuestes Buch in Eurer Buchhandlung.Corona + Recht

Was tun. - Was vermeiden.

Rechtsanwälte haben einen Verein gegründet. Dort bekommt man Unterstützung bei Repressionen durch den Staat.

Klagepaten.eu

Ihr findet dort auch Links zu Partnerseiten.

Corona Korrektur

Was wäre jetzt zu tun?

Natürlich wird dies nicht geschehen, denn irgendwelche Mächte haben ganz offensichtlich andere Pläne.

Aber man darf ja Wünsche (noch) äußern.

Corona Quartett 8.11.20

Servus tv - der einzige Sender mit Augenmaß?

Leider diesmal keine wirkliche Diskussion.

Von den Verbreitern von Angst und Panik traut sich offenbar keiner mehr zu servus.tv. Sie kriechen lieber unter die Decke des ORF, der bei der Zerstörung unserer Demokratie aktiv mitmacht.

Deeskalation

Aufruf eines Arztes?

Es gibt massive Angriffe auf Menschen ohne Maske.

Dies sollte aber nicht nur für Menschen mit ärztlicher Maskenbefreiung gelten.

Spanische Grippe

Bhakdi sprach im vorigen Beitrag auch über die Spanische Grippe

Könnte die 2. Welle auch HEUTE ein anderer Virus sein?

Auch 1918 war die 1. Welle relativ harmlos. Wikipedia

Im Herbst/Winter kam die 2. Welle. In den Jahren 1918/19 starben mind. 25 bis geschätzte 100 Millionen Menschen.

Corona Quartett 1.11.20

Servus tv - der einzige Sender mit Augenmaß?

Warum verbreiten unsere Politiker soviel Angst?

Warum zerstören sie sehenden Auges unsere Demokratie?

Man fragt sich, was unsere Oberschicht wohl dafür bekommt, wenn sie das eigene Volk derart belügt, täuscht oder gar verrät.

Talk im Hangar 7

Werden wir wieder weggesperrt?

Besonders beeindruckend ist Ulrike Beate Guérot.

Diese Politikwissenschaftlerin war herausragend in dieser Diskussion.

Sehr gute Auswahl der Teilnehmer durch die Redaktion. Warum bringt der ORF das nicht zustande.

Verhältnismäßigkeit

Sind die Corona-Maßnahmen verhältnismäßig?

Ein Beitrag von JF-tv

Ein sehr guter Beitrag um diese Frage eindeutig zu beantworten.

Pandemie ????

Bitte die Great Barrington Deklaration unterschreiben.

Es reicht nicht nur zu schimpfen.

Bitte unterschreibt die Deklaration.

Und teilt es mit Freunden.

Deklaration

Macht alle mit bei der Great Barrington Deklaration.

Endlich erwachen die Mediziner.

Wichtige Persönlichkeiten haben diese Deklaration unterschrieben.

Man darf gespannt sein, wie sich die Schuldigen herausreden werden.

Für Prof. Christian Drosten und andere wird es schwierig. Sie sollten uns aber nicht leid tun.

Wegscheider

Auch Herr Bhakdi berichtet von der Zensur im Internet.

Prof.Dr.med. Sucharit Bhakdi

Im 2. Gespräch mit dem Wegscheider.

Faktencheck

Lass dich nicht für blöd verkaufen.

Youtube versucht ständig, dieses Video verschwinden zu lassen.

Jeder kann sich selbst ein Bild machen.

Ist Judy Mikovits eine Verschwörungstheoretikerin oder glaubt man den ahnungslosen Journalisten, die sogenannte "Faktenchecks" produzieren.

ÖVP

Nichts aus der Vergangenheit gelernt?

Erst im Jahr 2017 trennte sich die ÖVP vom Bild des Diktators Engelbert Dollfuß. Bis dahin hing dieses Bild im Parlamentsklub der ÖVP.

Auch damals waren es vor allem hohe Beamte mit Mitgliedschaft im CV-Cartellverband die die Katastrophe zu verantworten hatten.

Mainstream ?

Erwachen jetzt auch die Mainstream Medien?

Wie zu allen Zeiten beginnen solche Dinge mit den Hofnarren.

Wahrscheinlich wurde das angestrebte Ziel bereits erreicht. Was immer dieses Ziel war.

WHO

Wie gefährlich ist die WHO ?

Gefährlich wird die WHO nur durch unsere Politiker.

Sie folgen blind den Empfehlungen von RKI und WHO, ohne andere Berater einzubinden.

Österreich 29.4.

Prof. Dr. Bhakdi bei ServusTV.

Herr Bhakdi erklärt ausführlich die Unsinnigkeiten des Corona-Wahns.

In 10 Tagen wissen wir es genau. Kommt eine 2. Welle? Und eine Katastrophe in Schweden?

Bhakdi schließt dies aus. Ein Karl Lauterbach dagegen lügt uns dann etwas anderes vor.Medizinische Fakten

Mediziner erklären Fakten zum Covid-19 Virus.

All das macht die politischen Entscheidungen der letzten Wochen immer fragwürdiger.

Es bleibt nur ein politischer Angriff auf unsere Demokratien übrig. Parlamentarische Untersuchungsausschüsse sind unabdingbar.Selbstdenken!

Ein Mindestmaß an der Fähigkeit selbst zu denken ist jetzt wichtiger denn je.

Markus Langemann

Medien Navigator

Zum Vergleich sehr gut geeignet.

Jeder kann sich verschiedene Meinungen zu einem bestimmten Thema ansehen. Dieser Navigator hilft bei der Auswahl der Medien.

Corona Wahnsinn

Völlig falsche Maßnahmen.

Zitat eines Virologen:

Die beste Waffe gegen diesen Virus ist der "gesunde Menschenverstand".

Hilfe! Wir sind unbewaffnet.

Zyklen und Crash

Wann kommt der nächste Crash?

Die beiden Bestseller Autoren Friedrich + Weik prognostizieren bis 2023 den Zusammenbruch. Wahrscheinlich wird dieser Wirtschaftscrash als Corona-Crash in die Geschichte eingehen. Dieser Virus lenkt hervorragend ab.

Absicht?

Astrologie und Crash

Was sagt die Astrologie zum kommenden Crash?

Es ist fast erschreckend wie präzise und genau das Horoskop den Crash 2008 wiedergibt. Und der zeitliche Ablauf des Kommenden ist ebenso bestechend. Nun kann man präzise gegen den Euro spekulieren.

Schuldgeldsystem

Franz Hörmann im Gespräch.

Hörmann ist ein brillianter Denker. Er ist allen Ideologen, die Anhänger von Hayek oder Keynes sind, überlegen.

Aber leider auch ein Phantast, der das Böse in der Welt falsch einordnet. Im Beitrag redet er auch kurz von der Bibel. Er sollte die Offenbarung lesen und versuchen sie zu verstehen.

Crashphobie

Andreas Beck hält nicht viel von den Crashpropheten.

Für Herrn Beck ist die Berechnung der Zukunft aus der Beobachtung der Vergangenheit nur sehr bedingt seriös, weil es zu viele Faktoren gibt, die nicht berechenbar sind.

Impfen

Ein junger Schulmediziner erklärt Impfreaktion, Impfkrankheit, Impfkomplikation und Impfschaden.

Wie üblich, kein Wort zu den Adjuvantien. Diese Wirkstoffverstärker sind der wahre Grund für die meisten Impfgegner. Diese Chemikalien, sind das wahre Gift beim Impfen. Lebendimpfstoffe, wie Masern, sind davon nicht betroffen.

Aluminium ist giftig

Aluminium wird völlig verharmlost. Unsere Nachkommen werden nicht verstehen, warum wir das so spät erkannt haben. Aluminium als Wirkstoffverstärker beim IMPFEN in gesunde Babys zu spritzen ist wohl die größte aller Sünden.

Glaubt doch den wenigen Forschern, die gegen eine übermächtige Lobby ankämpfen. Sie sind die letzte Hoffnung einer Gesellschaft, die jeden Anstand verloren hat.

CO2

Das Gas CO2 wird durch viel Geld als Ursache des Klimawandels propagiert. Ein ECHTER Klimatologe erklärt hier die wahren Zusammenhänge.

Glaubt nicht den bezahlten Propagandisten. Wie z.B. den österreichischen Wettersprecher Marcus Wadsak mit seinem neuen Buch.

Greta

Greta Thunberg bei Merkel. Dieses Beispiel zeigt das Ausmaß der Verblödung unserer Gesellschaft.

Es begann mit einem gröllendem deutschen Sänger, dessen Stimme nicht alle begeistert.

Ernährung und ........

Es gibt noch Wissenschaftler die dem Regime widerstehen.

Der Biochemiker Andreas Noack ist einer dieser Wissenschaftler. Seine Erkenntnisse sind oft das völlige Gegenteil dessen, was die offizielle Wissenschaft propagiert. Es bleibt einem mündigen Bürger nicht erspart, sich wichtiges Wissen selbst zu erarbeiten.

Crash 2020

Megacrash voraus: Banksystem 2020 am Stress-to-Break Punkt.

Auch Markus Krall ist ein Bestsellerautor, der das Systemende prophezeit.

Nach dieser kommenden Krise wird auch die ganze Gesellschaft verändert sein. Auch ohne 3. Weltkrieg wird das Ergebnis jenes sein, das so manche Eliten vor langer Zeit als Ziel definiert haben.